The International Finance Corporation (IFC), a member of the World Bank, will be providing advisory support to Lift Above Poverty Organisation(LAPO).

This support will play a significant role in expanding the microfinance business beyond Nigeria and Sierra Leone, where it boasts over 495 branches, serving over 800,000 customers.

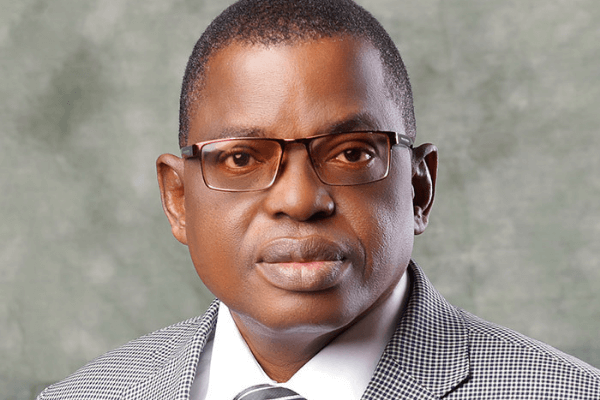

“Through IFC’s advisory support, we will expand our capacity to build greater financial inclusion among a rural, low-income client base in sub-Saharan Africa. IFC’s advisory will also help us deepen our efforts to reach more women-owned micro enterprises, which currently represent about 70 per cent of clients in our existing microfinance operations.” Founder and chief executive officer, LAPO, Dr Godwin Ehigiamusoe

LAPO’s planned microfinance expansion will help boost financial inclusion and increase lending to individuals and micro and small businesses in the region, stimulating economic activity. The expansion will specifically target women borrowers, low-income earners, and those in rural areas.

“IFC’s support to LAPO is part of our commitment to strengthen economic development in sub-Saharan Africa, support micro enterprises, and reduce poverty. This project marks a significant milestone in the development of microfinance in Africa, particularly as countries continue to suffer severe effects of the COVID-19 pandemic.” IFC’s regional director, Southern Africa and Nigeria, Kevin Njirani.

In fragile and conflict-affected situations, individuals and businesses struggle to access loans and other banking services because of underdeveloped domestic financial sectors.IFC strive to boost private sector growth and job creation, and supporting financial inclusion is an essential part of the group's strategy.

Nigeria in focus

GDP: $448.12 Billion compared to Ethiopia's $95.913 Billion in 2019

Population: 200,963, 599 compared to Ethiopia's 112,078,730 in 2019

GDP per capita: $2,229 compared to Ethiopia's $855 in 2019