In the world of digital transformation, change often comes from the most unexpected quarters. The recent move by Directline Assurance in Kenya is a striking example of this phenomenon.

The Unlikely Change Agent: Directline Assurance

Directline Assurance, a dominant player in the public service vehicle (PSV) insurance sector in Kenya, has taken a groundbreaking step. The company has mandated all operators of matatus (minibuses) it insures to adopt cashless fare platforms starting February 1. This decision, as reported by Business Daily Africa, is more than just a new business strategy; it's a significant push towards digitizing the chaotic public transport system in Kenya.

The Impetus for Change: Combating Fraud

The motivation behind this move is Directline's development of a passenger manifest system. This system aims to validate third-party insurance claims, providing evidence to confirm that claimants were indeed passengers in the vehicles involved in accidents. This is a strategic approach to mitigate fraud, a perennial challenge in the insurance industry.

Broader Implications: A Boon for Banks, FinTechs, and Telcos

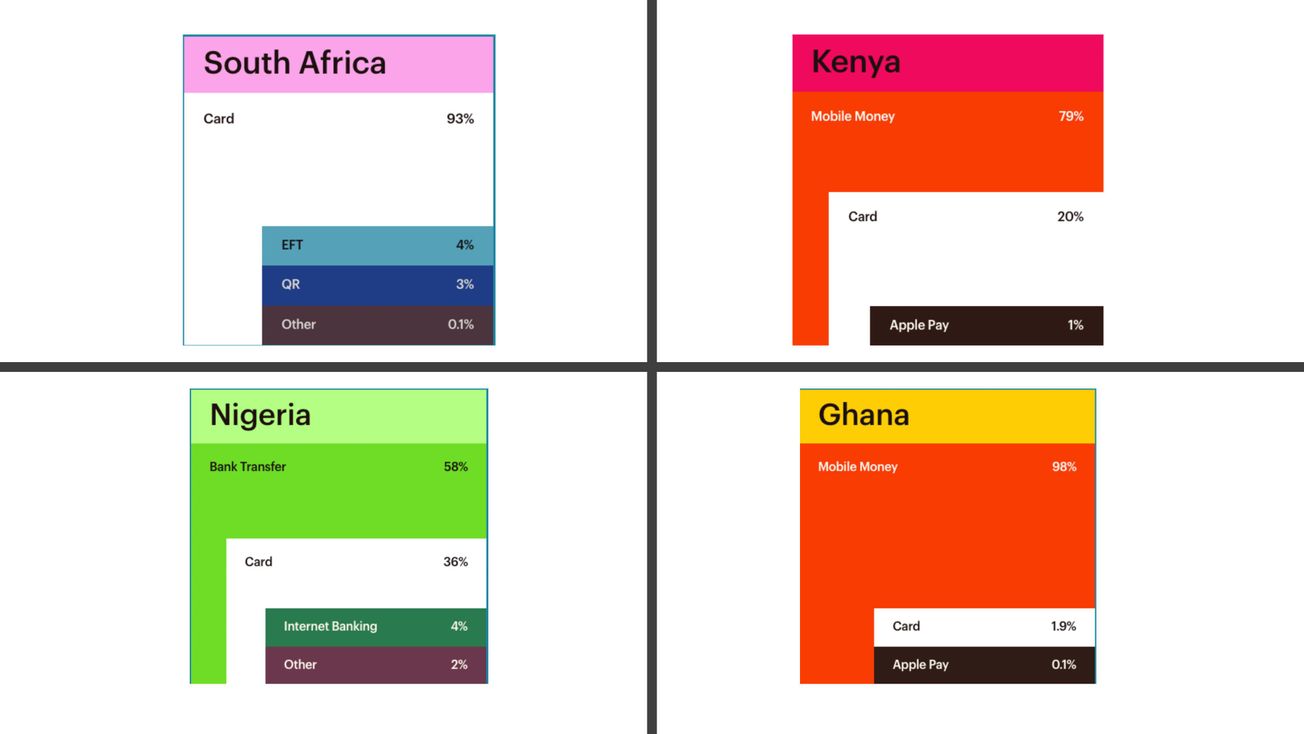

This directive by Directline Assurance is set to be a game-changer for various stakeholders in the financial ecosystem. Banks, FinTech companies, and telecommunications firms stand to benefit significantly. These entities, which provide the infrastructure for cashless transactions, are likely to see a boost in their payment volumes, values and their services' usage. This move aligns with the broader trend of digital financial services expanding across Africa.

A New Chapter in Kenya's Digital Journey

Kenya has been at the forefront of digital innovation in Africa, notably with the success of mobile money platforms like M-Pesa. However, integrating digital payments into the public transport sector has been a longstanding challenge. The sector, characterized by its informal and often disorganized nature, has been resistant to such changes. The intervention by an insurance company to instigate this shift is both innovative and surprising.

Looking Ahead: The Power of Unconventional Solutions

As we observe the rollout and impact of this directive, it will be crucial to monitor how it influences the broader digital payments ecosystem in Kenya and potentially across Africa. This development could serve as a blueprint for similar initiatives in other sectors and countries, driving further digital inclusion and innovation. Furthermore, Directline's move is a vivid illustration of how innovation can emerge from the most unexpected places, challenging us to think creatively and collaboratively in the quest for digital transformation.