The Central Bank of Nigeria on September 29, 2020, launched the framework for advancing women’s financial inclusion. The launch of the framework was announced in an online event tagged “Access to Finance Framework for Women”.

The framework was conceptualized by the Financial Inclusion Special Intervention Working group and developed by the CBN in collaboration with EFInA and Women’s World Banking with input from over 50 stakeholder institutions.

The overarching vision of the framework is for Nigeria to be globally recognized, with an inclusive financial sector that has closed the gender gap by 2024. The framework further itemizes 8 strategic imperatives for driving improved access to finance for women in Nigeria.

In the online event, the Deputy Governor, Financial System Stability of the Central Bank of Nigeria, Mrs. Aisha Ahmad justified the new initiative by citing EFInA’s last report on financial inclusion in 2018 as a yardstick.

For reference, the report stated that 40.9% of females were financially excluded as against 32.5% of males. And, Mrs. Ahmad remarked that perhaps, the figures might even be wider if unattended to especially in this period of crisis.

Mrs. Ahmad urged financial institutions to address structural issues limiting women’s access to finance by understanding and developing products that are specifically tailored to address such issues.

What This Means for Women’s Inclusion in Nigeria

Empirical studies have shown that supporting a stronger role or empowering women is a key enabler in reducing poverty, stimulating economic growth and ensuring sustainable development. Citing ‘’The Power Parity Report by McKinsey’’, the Director of development finance department of CBN, Mr Yusuf Philip Yila, stated that the economic consequences of pursuing gender equality include a potential addition of $28trillion to global annual GDP by 2025.

Aligning her efforts towards contributing to achieving these broad benefits of poverty reduction, and economic growth and development, the CBN, via this framework, has centred its efforts towards women’s financial inclusion between now and 2024 around eight strategic imperatives. These imperatives are geared towards creating a sustainable financial services platform to serve Nigerian women. The imperatives include:

1. Expansion of the issuance of National Identity Numbers to reach all Nigerian women, among other actions to ensure increased account ownership for women.

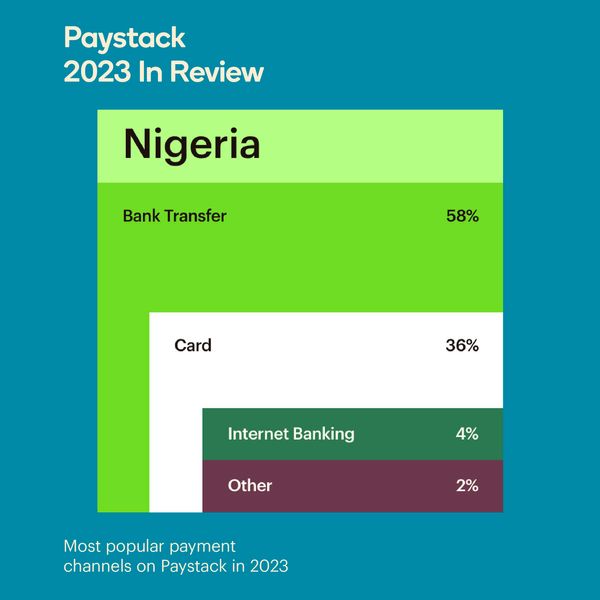

2. Raise awareness and incentivize the value chains for cashless transactions.

3. Digital and Financial literacy education for women.

4. Expand delivery channels to serve women customers closer to home

5. Gender-considerate data collection

6. A Gender-considerate fintech market, which provides products aimed at financial inclusion for women.

7. Develop financially sustainable products and delivery systems that respond to low income women's needs.

8. Promoting a culture of women's leadership and staffing in financial institutions and other key agencies.

In conclusion, this policy initiative is a big boost to achieving SDG’s goal of gender equality and Nigeria’s financial inclusion targets simultaneously, and is a welcome development from every point of concern. However, we hope that all stakeholders are carried along and adequately supported in its implementation.

Nigeria In Focus:

Population - 206.6 million (Compared to South Africa's 59.6 million)

GDP: $504.57 billion (Compared to South Africa's $369.85 billion)

GDP Per Capita: $2,465 (Compared to South Africa's $6,193)