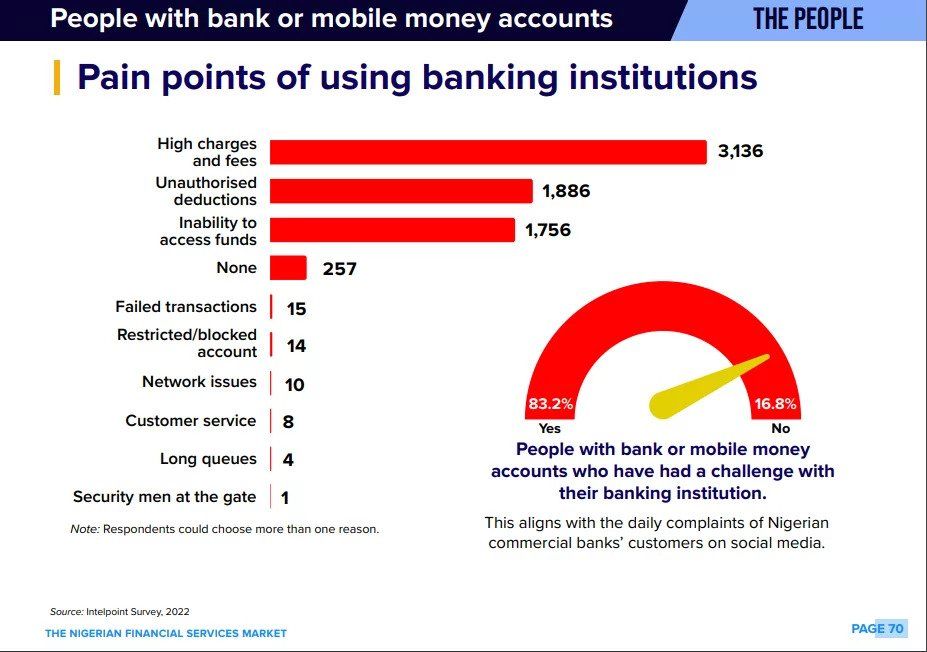

In recent years, neo-banks emerged with exciting, innovative offers and efficient digital banking models, and they delivered these services through online platforms and mobile apps, emphasising convenience, access to 24/7 services and a cost-effective experience to my customers worldwide. In Nigeria, Neo-banks and other fintechs took the financial industry by storm, offering state-of-the-art technology, lower interest rates, and zero charges on deposits and withdrawals, challenging traditional banks' long-term dominance of the financial industry.

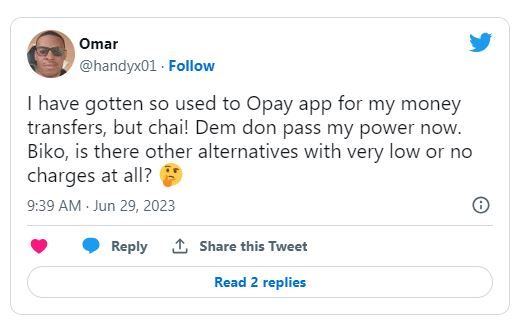

Nigeria is home to neo-banks like Kuda, Opay, Carbon and VBank, which have offered the country's tech-savvy population (millennials and GenZ) an escape from long queues, complex paperwork and excessive charges. However, most new banks have struggled to sustain their free service offers. The likes of Opay showered their customers with zero charges but took a U-turn on free transfers and started charging N10 after the first three transfers of customers in a day. Kuda also offers 25 free transfers, after which customers are expected to pay a N10 charge. Leaving many wondering if the zero-charge offers are genuine or mere marketing schemes.

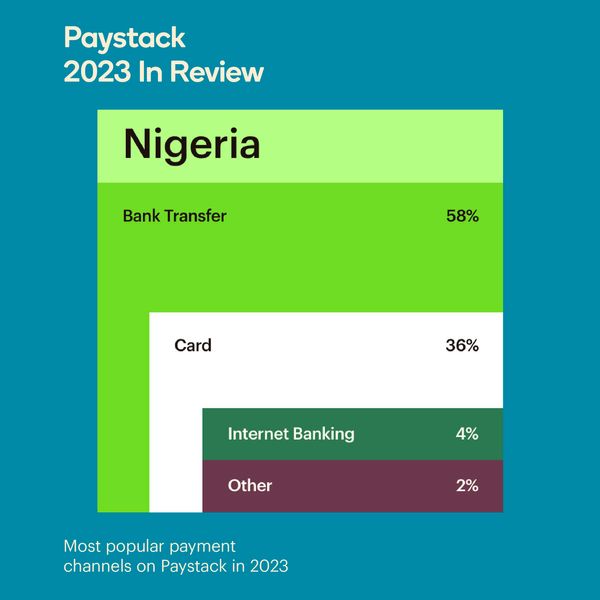

There are several factors at play in Nigeria's fintech industry, and most times, these factors determine the direction of many neo-banks and fintechs. As an instrument of government, the Central bank is a major game changer as it imposes directives on all in the industry. Also, as all businesses Neo-banks and fintechs in Nigeria look forward to generating revenue, they do this by relying on interchange fees. However, while transaction charges may be a minor source, they offer an alternative channel for generating revenue.

Survival is key for Neo-banks and fintechs in Africa's largest economy, considering the nature of Nigeria's financial ecosystem and the rivalry by big commercial banks. But would policy decisions or marketing strategy be their nemesis? Seeing how things play out in the financial industry would be interesting.