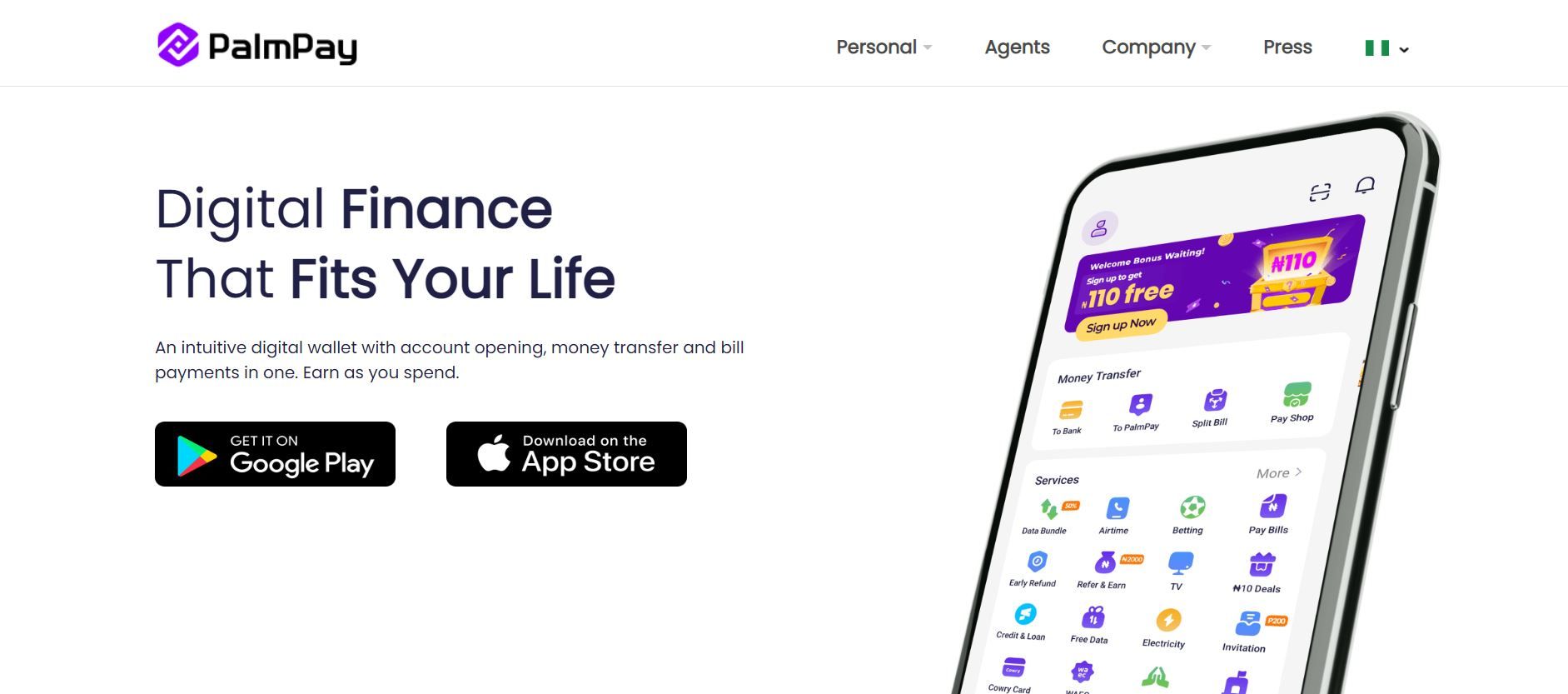

Digital wallet and payment startup PalmPay celebrates 25 million users on its smartphone app in Nigeria, revealing how successful the fintech has been in its commitment to driving financial inclusion in the country. Since beginning operations in 2019, PalmPay has promoted cashless payments via its mobile app payment products and has successfully built a merchant base of over 200,000 people with its POS product.

Through FinTech's like PalmPay, Nigeria’s journey toward a cashless economy has gained momentum. With the likes of PalmPay in the country, many Nigerians have found an easier approach to making transfers, bill payments, and airtime purchases and still get cashback rewards. PalmPay’s offerings have successfully accommodated the needs of individual customers and businesses, growing its customer base network. Beyond its services, the fintech company has helped boost the employment rate in the country as many retail merchants now hire operators for their POS businesses.

Influencing the biggest economy in Africa is challenging, as there are so many obstacles to investment and the drive for financial inclusion. Regardless, encouraged by its 25 million user milestone, PalmPay hopes to continue its drive toward digitizing the economy of Nigeria and the rest of Africa.

Focus Box

Company Name: PalmPay

Industry: Payments, Financial Services

Founded: 2019

CEO: Chika Nwosu

Funding raised: N/A

Revenue: N/A

Customer base: 25,000,000

Key countries: Nigeria