Last month the RBZ’s Monetary Policy Statement revealed that the date for ZimSwitch becoming the National Switch was the 30th of September. That date was an extension for the previous date set which was the 15th of August. The initial date that was set was a little ambitious because the integration that the RBZ required of EcoCash and other mobile money operators was very complicated.

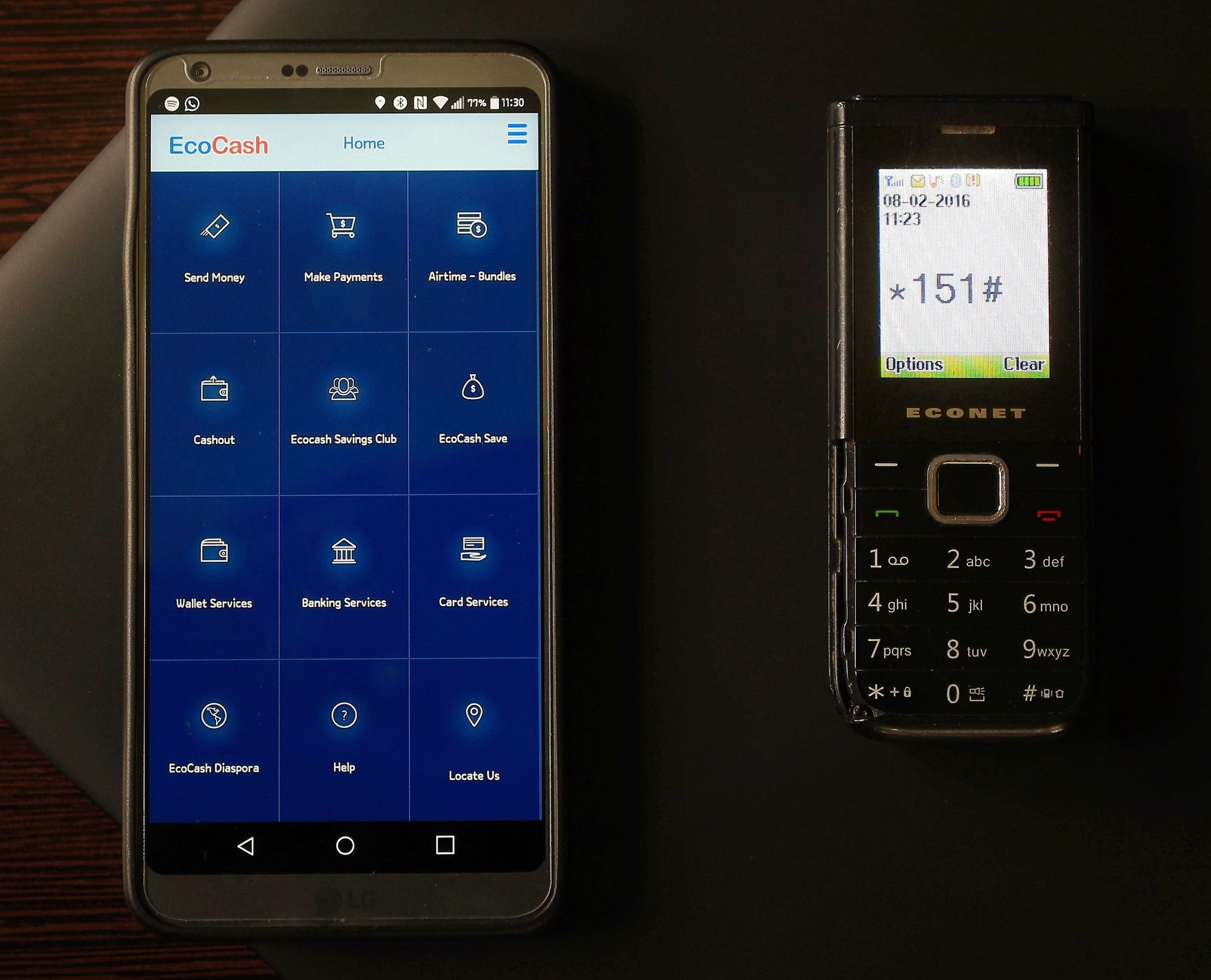

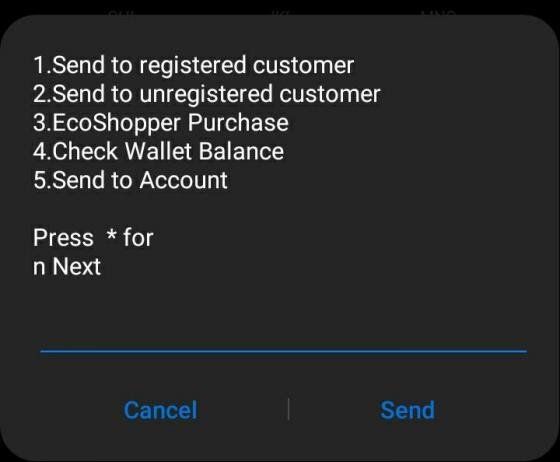

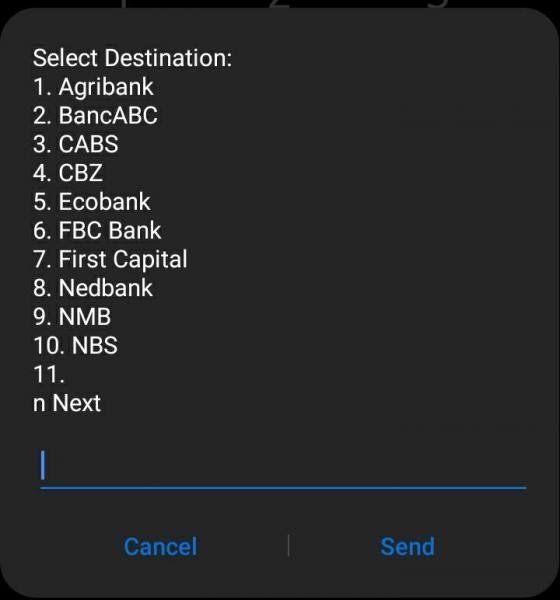

Well, the final deadline has passed and it appears that EcoCash was able to get it over the line. If customers dial *151# under “Send Money” consumers can see options that reveals all the different accounts that you can now send money to

My opinion

African billionaire, Strive Masiyiwa, is one of the 14 million persons that make up the population of Zimbabwe. I would better describe him as the Jeff Bezoz of Zimbabwe. Strive's Econet Zimbabwe, which was once operating in Nigeria, has well over 10 million customers likewise Ecocash, Econet's mobile wallet subsidiary with over 10 million customers; making Econet, a market leader in the Telecom and financial services sectors. Similar to the position that Safaricom is enjoying today in Kenya.

Unlike Safaricom's Mpesa in Kenya, Ecocash maintained a strong position in the market by ensuring that its customers could not transfer funds to other bank or mobile wallet accounts that is not Ecocash. After several years, the government announced a national payment switch and made cross transfer compulsory. This move brought to end, Ecocash's monopolistic powers and opened up the market for health competition.

The next play is payment economics because of the associated charge for sending money to other banks or wallets.

Considering the economic tsunami in Zimbabwe, customers would likely not be willing to pay the extra fee to send money to a bank account or other wallets. Recall that EcoCash has 10 million customers in a country with a total population of 14 million. Hence, there might be no need to use another wallet, when staying on EcoCash allows you to do fund transfers cheaper.

The relevance of digital financial services in Zimbabwe can't be overemphasized because of the cash shortage crisis, making mobile money account for over 85% of all transactions in the country.

Zimbabwe in Focus (2019)

Population - 14 million (Compared to South Africa's 59.6 million)

GDP: $21 billion (Compared to South Africa's $369.85 billion)

GDP Per Capita: $1,464 (Compared to South Africa's $6,193)