Africa currently consists of 54 fragmented markets, some of which are amongst the fastest-growing markets globally, yet trade within the continent is the lowest globally. According to the 2020 Africa trade statistics yearbook, South Africa, Nigeria, and Egypt accounted for the largest share of the intra-Africa trade export amounting to 39%, while Angola, South Africa, and Nigeria accounted for the largest share of the intra-Africa trade import amounting to 40%. The growth trajectory of the Intra African trade volume has shown a sluggish and declining trend over the last seven years, with an average of 13% for imports and 20% for exports. To strengthen intra-regional trade and foster economic development and integration in Africa, the Africa Union charter developed the African Continental Free Trade Area (AfCFTA).

The main driver of the AfCFTA formation is the subtle removal of 90% of tariffs on goods allowing for free flow of capital, investment, people, and further development of the Continental customs union. This agreement aims at creating a single continental market of 1.27 billion consumers with an aggregate GDP at PPP between $2.1 and $3.4 billion. Aggregate private and business-to-business consumption is expected to constitute $4 trillion and, in addition, to the growth of Intra Africa trade by 52.3%. The growth potential on Africa's demographic features resonates with the need to construe the AfCFTA agreement because of the demand’s potentials forecasted to meet accelerated economic development and integration. AfCFTA is poised to be the single most extensive free trade zone on the planet.

Africa has low levels of export complementarity – a measure of the diversity of goods imported and exported from the rest of the world. There’s a need to compartmentalize the threshold to unlock more significant levels of Africa’s integration through the emergence of regional value chains. The purposeful implementation process is heavily dependent on the extent of growth capacity, governance, infrastructural development, and technology to harmonize trade policies accompanied by dynamic benefits notably, export diversification, sustainable growth, enlarged regional market to attract foreign direct investments in African countries, more expansive economic space for industrialization and a catalytic effect on structural transformation.

Going into the implementation phase of AfCFTA demands that African countries solidify their digital economy towards creating an environment that facilitates innovation across the sectors critical to the success of the AfCFTA as this will potentially open a sphere of opportunity and promising partnerships in the regional market. Three digital innovations are worth considering to support the implementation of the AfCFTA and they are in tandem with the free trade facilitation pillars of physical flow, data flow, and payment flows. The three digital innovations to be addressed in this discourse also spreads across the three sectors that are pivotal to the implementation of the AfCFTA, they include -

Smart shipping technique for the maritime sector

The new catch in the maritime sector is smart shipping; it promises increased efficiency and productivity. Smart shipping refers to the automated interoperability of large sea vessels on onshore and offshore. This system uses data collected by sensors through an advanced system to navigate speed and route plans, hence making the crew more efficient in their tasks, ensuring cost-effectiveness, and environmentally friendly innovation because of its fuel-efficient system, which prompts the Maritime sector to be more efficient competitive and attractive.

This technology covers entrance authorization, video surveillance and analytics, behavior analysis, anti-theft and anti-fraud, biometric authentication solutions, and a sensor-based system that helps vehicles and cargo handling equipment be aligned adequately for safety, physical and cyber security. This advancement is estimated using real-time data to save operators approximately $80,000 when they dock a vessel.

Electronic single window for customs operations management

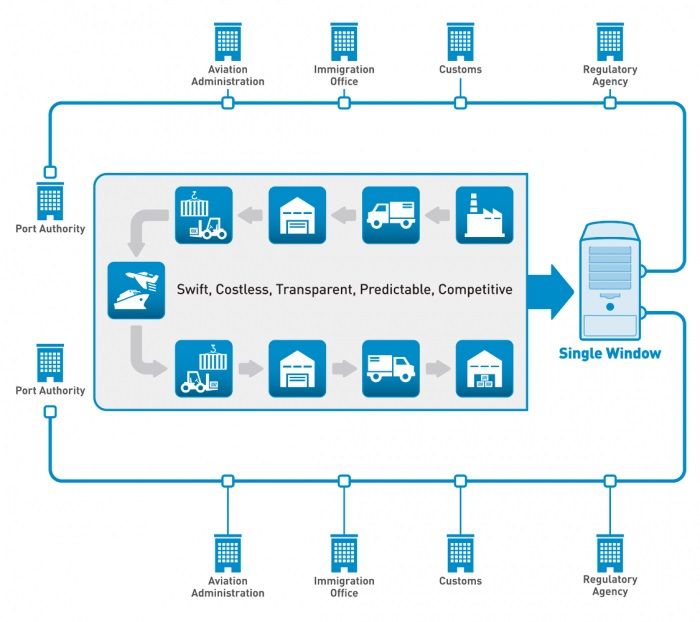

This single window development is an emerging incremental implementation of IT technology for custom processing, data input, and exchange. This window system creates a user-based interface that prompts traders to precede all documentation procedures relating to imports and exports while connecting major cross-border regulatory agencies and collecting necessary data through a single electronic submission. The ASYCUDA (Automated system of customs data) had limited functionalities hence the fallout due to the complexity of the external environment.

The Electronic single window can complement supply chain automation, dematerialization, and national and international interoperability. The electronic submission aims to conduct a risk assessment based on prior trade document procedures between customs and other control agencies to ensure logistics, ports, supply chain, payment integration, and better interoperability among African countries.

Decentralized trading account for the payment sector

Decentralized finance is a complete ecosystem that embodies various financial applications built on blockchain technologies typically using smart contracts. This system can overhaul the inflexibility of current processes, facilitate payments or convert payment amounts to USD-backed stable coins for cross-border remittance. Unlike traditional databases administered by a central entity, blockchain relies on peer-to-peer transactions (P2P) that no single party can control. The lack of centralized authority to monitor and control financial transactions strictly grants autonomy, high security, immutability, and traceability to prevent fraud in the trading world.

This makes Defi much safer and eliminates the possibility of malicious hackers. Blockchain’s trade-related applications are numerous and could significantly transform trade finance, customs, and certification processes. This innovation is a game-changer to digitize and automate trade finance processes; it could become the future infrastructure in the services industry. The intrinsic characteristic of this technology also makes it a potentially interesting tool to help implement the AfCFTA agreement.

Conclusively, harnessing the full potential of the AfCFTA agreement requires exploiting the gains from digital innovations in unifying the African community. There's a need to emphasize digital inclusiveness that offers a chance to disrupt the trajectory by unlocking new pathways which are more result-oriented and cost-efficient. Hence, the need to adopt smart shipping technology as a transformative trade measure for the Maritime Sector, a single-window system that facilitates trade data flows, and decentralized trading account as a remedy for limited functionalities in existing technologies.