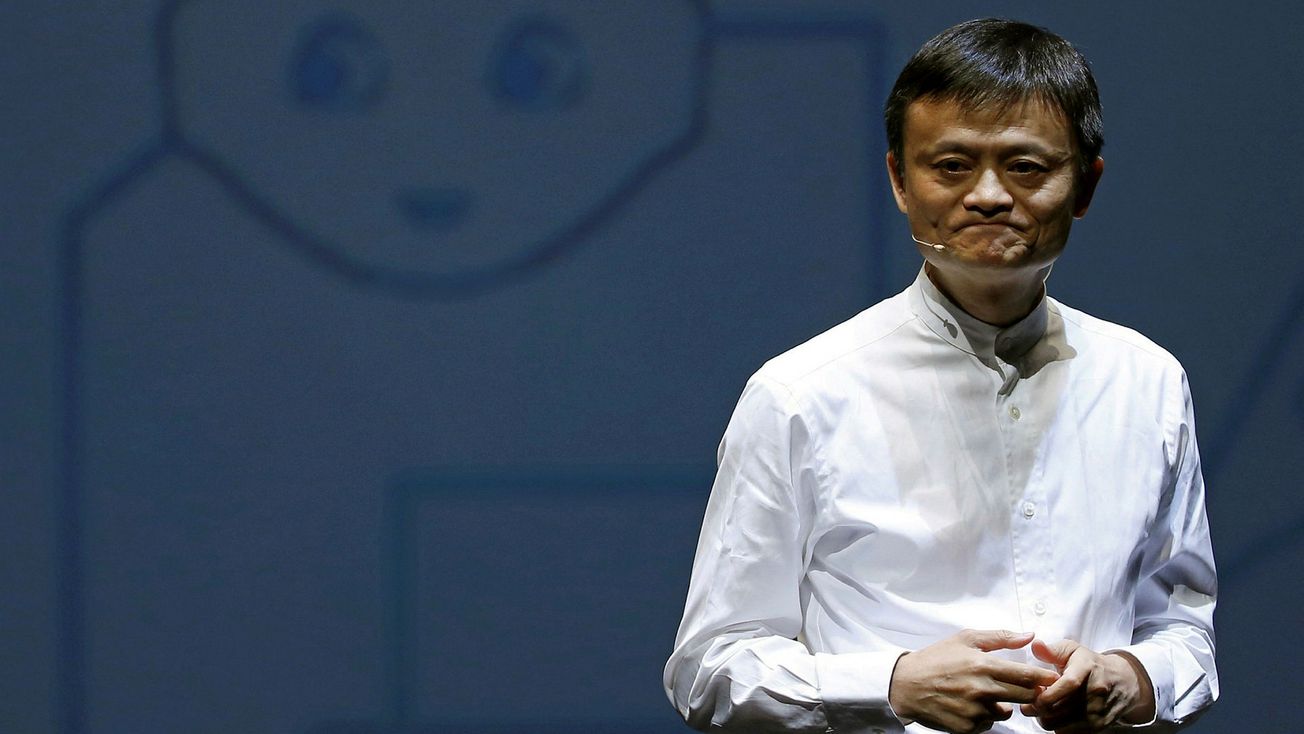

China has halted the $37bn listing of Ant Group, which was set to become the world’s biggest IPO, a day after regulators Ant Group's founder, Jack Ma.

China’s largest financial technology company was set to list on Thursday in Shanghai and Hong Kong in a record-breaking IPO that had attracted huge interest from institutions and smaller investors.

However, Mr Ma, was called in for “supervisory interviews”, according to the Shanghai Stock Exchange, which then cited “other major issues”, besides changes in “the financial technology regulatory environment”.

The stock exchange informed Ant and its underwriters, including Goldman Sachs, JPMorgan and China International Capital Corp, among others, to release the news about the suspension. It also said investors would be refunded “application monies” relating to the IPO.

In light of this, while shares in Alibaba, the Chinese ecommerce group with a 33 per cent stake in Ant, were down by 9 per cent in early trading in New York, Ant apologised to investors and said it would “keep in close communications with the Shanghai Stock Exchange and relevant regulators . . . with respect to further developments of our offering and listing process”.