The Central Bank of Nigeria has ordered banks operating in the country to start charging a cybersecurity levy on transactions. On Monday, a circular from the apex bank disclosed that the levy's implementation would start two weeks from today.

The move is reported to be part of the CBN's efforts to curb fraudulent transactions and sanitise the financial sector.

"The levy shall be applied at the point of electronic transfer origination, then deducted and remitted by the financial institution. The deducted amount shall be reflected in the customer's account with the following narration: "Cybersecurity Levy," the CBN said in the circular.

The implementation followed the enactment of the Cybercrime (Prohibition, Prevention, etc.) (Amendment) Act 2024 and under Section 44 (2)(a) of the Act, which provided for the rate deduction.

The circular, dated May 6, 2024, was addressed to all commercial, merchant, non-interest, and payment service banks, other financial institutions, Mobile Money Operators, and Payment Service Providers and was jointly signed by Chibuzo Efobi, CBN Director, Payments System Management Department, and Haruna Mustafa, Director, Financial Policy and Regulation Department.

Once deducted as instructed, financial institutions will remit the money to the National Cybersecurity Fund (NCF), which will be managed by the Office of the National Security Adviser (ONSA).

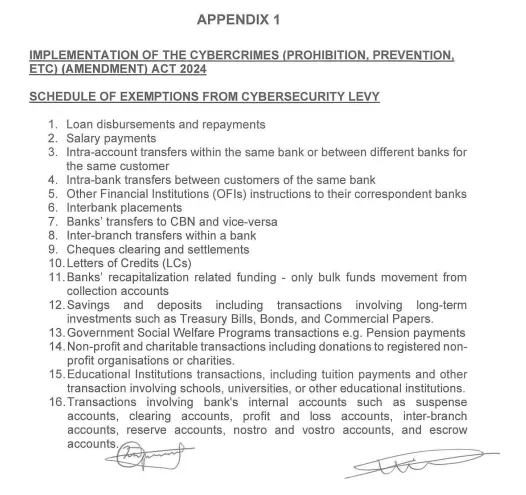

However, the CBN exempted 16 categories of transfers from the e-levy, including salaries, loans, cheques, and clearing and settlements.