Apple Inc. announced the discontinuation of its 'buy now, pay later' (BNPL) service, Apple Pay Later, in the United States just months after its launch. This strategic shift marks a retreat from Apple's ambitions to become a significant provider of traditional financial services.

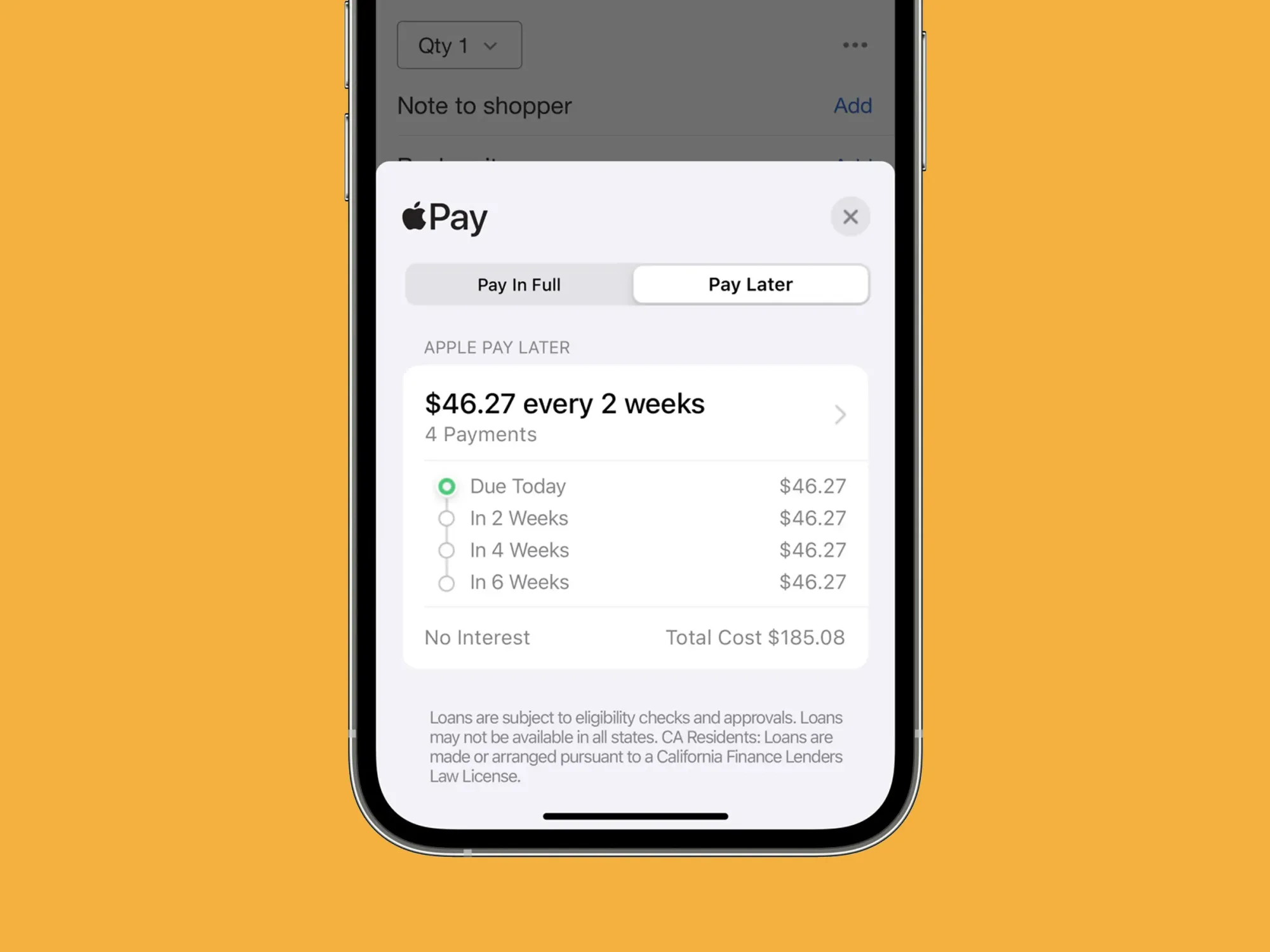

Introduced in March 2023, Apple Pay Later allowed users to split purchases into four equal instalments over six weeks with no interest or fees. However, Apple is now pivoting to a new global instalment loan service offered through third-party credit and debit cards, aiming to expand its financial services offerings globally.

This strategic shift reflects Apple's cautious approach to navigating the challenges of the BNPL industry, such as regulatory scrutiny and market pressures, while still providing flexible payment options to its customers.

This new service will be available through partnerships with banks and lenders such as Citi, Synchrony, and Affirm in the US, as well as HSBC and Monzo Bank in the United Kingdom. Existing users of Apple Pay Later will still be able to manage their loans, but no new loans will be issued.

By partnering with established financial institutions, Apple aims to expand its global reach and maintain its focus on secure and convenient payment solutions.