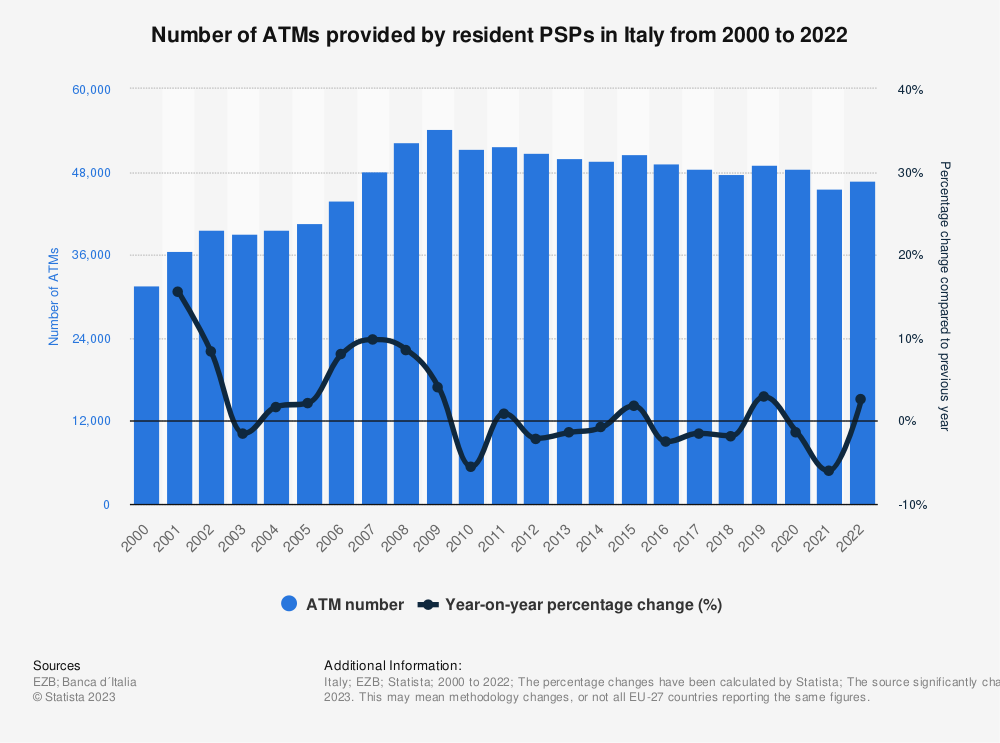

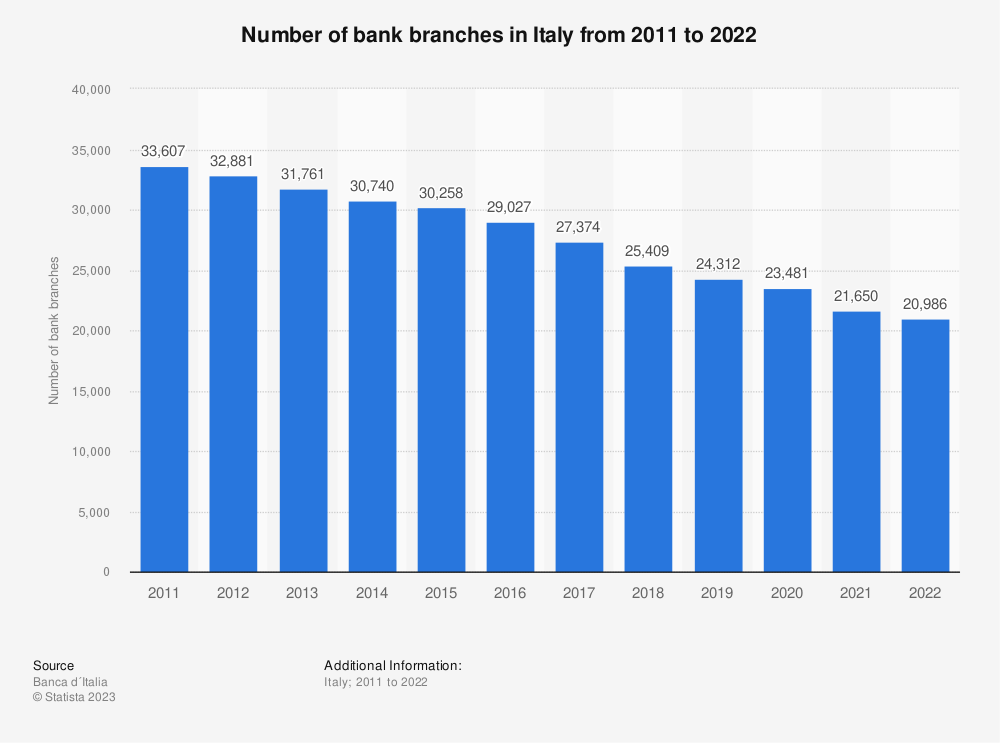

In the realm of financial inclusion and accessibility, the recent initiative by the Italian government, as part of their 2024 budget law, to enable cash withdrawals at point-of-sale (POS) terminals in shops is a noteworthy development. This move, aimed at addressing the shrinking number of ATMs and bank branches, particularly in remote areas, mirrors an approach long embraced in the African financial landscape: the agent banking model.

The Italian Scenario

Italy's decision to allow cash withdrawals at various commercial establishments, like pharmacies and supermarkets, using POS terminals is a strategic response to the evolving financial needs of its citizens. This approach not only facilitates access to cash, especially in underserved areas, but also aligns with the global trend of declining cash usage, despite Italy's higher-than-average cash dependency compared to other European countries.

Africa's Agent Banking Model: A Pioneer in Financial Inclusion

The concept of using non-bank retail agents to provide financial services is not new. In Africa, the agent banking model has been a cornerstone in driving financial inclusion. Countries like Kenya have been pioneers in this domain, leveraging the widespread network of agents to offer banking services such as deposits, withdrawals, and money transfers, even in the most remote areas. This model has been instrumental in bringing a significant portion of the unbanked and underbanked population into the formal financial system.

Synergies and Learning Opportunities

The Italian initiative to use POS terminals for cash withdrawals and the African agent banking model share a common goal: increasing financial accessibility. Both approaches demonstrate the importance of adapting financial services to local contexts and needs. While Italy's focus is on leveraging existing POS infrastructure, the African model capitalizes on the extensive reach of local agents and merchants turned agents.

For financial institutions and policymakers, there are valuable lessons to be gleaned from these models. The key lies in understanding the unique challenges and opportunities within each market and innovatively using existing infrastructure to bridge the financial inclusion gap.

Conclusion

The convergence of these two approaches - Italy's POS-based cash withdrawal initiative and Africa's agent banking model - offers a fascinating glimpse into the future of financial services, where accessibility and inclusion are at the forefront. As we move towards a more digitally inclusive world, these models provide valuable insights into how technology and innovative thinking can be harnessed to meet the diverse financial needs of populations worldwide.