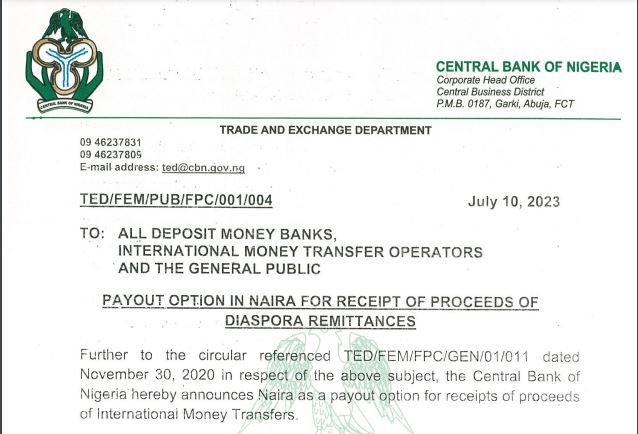

In its latest circular, the Central Bank of Nigeria has authorised banks and International Money Transfer Operators (IMTOs) in Nigeria to commence remittance payment of the Naira to beneficiaries. It is ending a three-year ban on banks and other financial institutions from paying beneficiaries in Naira. However, the Naira payment is only optional in addition to the US dollars and e-Naira, which are already available in receiving diaspora remittances. Payouts will be done in compliance with the Investors’ & Exporters’ window rates.

A diaspora remittance is a money transferred from one person to another, typically sent by someone working abroad back to their home country. In Nigeria, diaspora remittances have emerged as an effective tool for fostering the growth of businesses and cushioning the effects of FX scarcity; according to the World Bank, Nigerians in the diaspora have remitted about $168.33 billion in the last eight years.

Recognising the potency of diaspora remittance in shifting economic conditions, the CBN has sought to improve the experience of customers in Nigeria by offering them the luxury of choice in receiving funds, which can now be in foreign exchange, e-Naira or Naira. As most money transfers or remittances in Nigeria are done to support relatives, the CBN is looking to ensure that people in both Urban and rural areas can easily access the finances they need in Naria. The latest decision is also an effort by the CBN to improve the liquidity and stability of the FX market.

Also, to encourage growth and a sustainable future for the remittance industry, the apex bank updated its list of registered IMTOs from 47 approved in 2021 to 62 companies. The advent of fintech companies has significantly changed the remittance market, making sending and receiving money easier and cheaper.